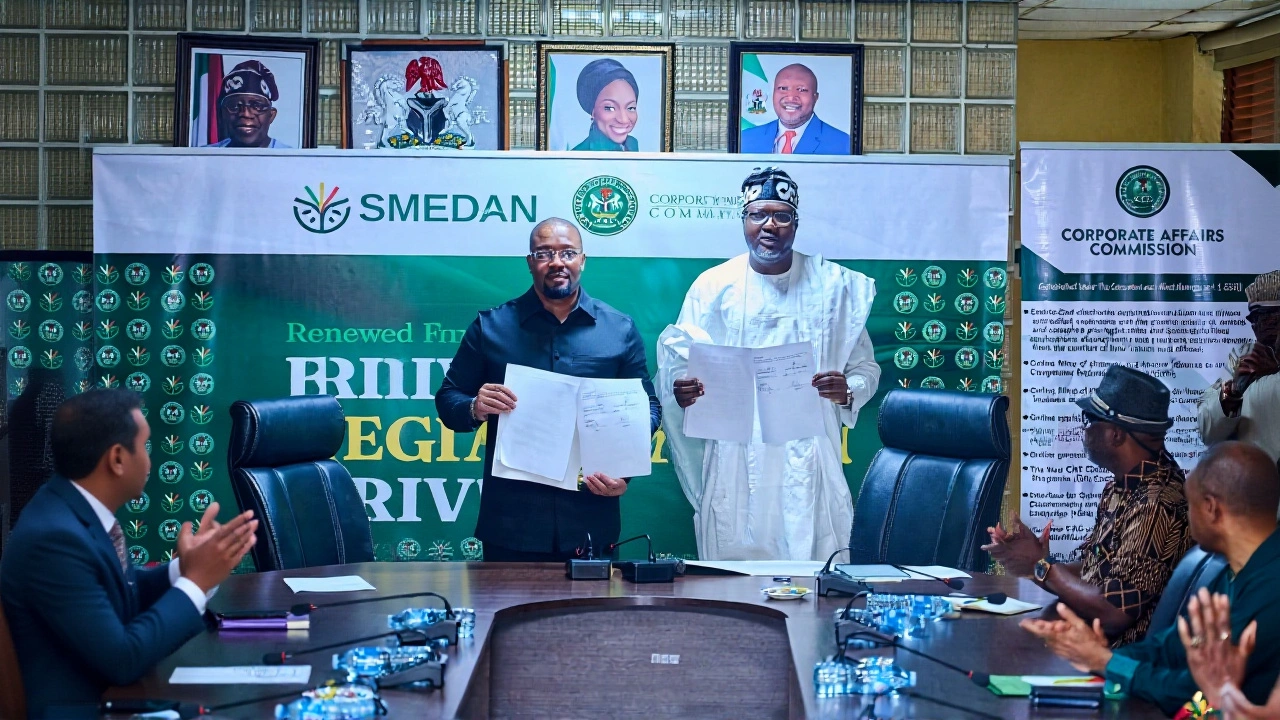

When Corporate Affairs Commission (CAC) teamed up with Small and Medium Enterprises Development Agency of Nigeria (SMEDAN) on September 27, 2025, they unveiled a nationwide push to give 250,000 micro, small and medium enterprises (MSMEs) in Nigeria free business registration. The drive, covering all 36 states and the Federal Capital Territory (FCT), isn’t just about a name on a certificate – it bundles loans, grants, insurance and training into a single, formalised package.

Background to Nigeria's MSME Landscape

MSMEs have long been the backbone of the Nigerian economy, accounting for roughly 90% of all businesses and contributing about 48% of GDP, according to the National Bureau of Statistics. Yet informal operations dominate: a 2023 survey showed that nearly 60% of MSMEs operated without formal registration, limiting their access to credit and government support.

Policy makers have tried various incentives over the years, but high registration fees and bureaucratic red tape kept many entrepreneurs in the shadows. That’s why the CAC‑SMEDAN partnership feels like a turning point – a coordinated effort that tackles both cost and complexity at once.

Details of the Free Registration Initiative

The programme, officially titled the Business Gro program, promises to register up to 250,000 eligible firms at no charge. Registration is processed through the portal portal.smedan.gov.ng, where businesses fill a simple online form. No hidden fees, no extra paperwork – just a few clicks and a confirmation email.

According to Dr. Olufemi Olatunji, Director of Programs at SMEDAN, “We wanted to remove the first barrier to formalisation. When a business has a recognised name, it can start tapping into the ecosystem of financing, insurance and training that we’ve built.”

The initiative is guaranteed – even if future policy reviews shift, the 250,000 free registrations will remain honoured, officials said.

How MSMEs Can Register

Steps are straightforward:

- Visit portal.smedan.gov.ng and click “Free Registration”.

- Enter business details (name, sector, state, contact information).

- Upload a government‑issued ID for the owner and a proof‑of‑address document.

- Submit the form; the system generates a provisional registration number within 24–48 hours.

- Finalize the registration at the nearest CAC office or complete an online verification if the state permits.

For firms that have lost their SMEDAN number or email, a recovery option uses the registered phone number, and assistance is available via [email protected].

Benefits Beyond Registration

Once formalised, a business unlocks a suite of advantages:

- Access to Loans: Partner banks such as Access Bank, GTBank and First City Monument will offer collateral‑free micro‑loans up to ₦5 million for registered MSMEs.

- Grants from both federal programmes (e.g., the Youth Enterprise Development Initiative) and private foundations like the Tony Elumelu Foundation.

- Insurance packages covering fire, theft and business interruption, subsidised through the Nigerian Insurers Association.

- Free professional training – digital marketing, bookkeeping, and export readiness – delivered by industry experts via the SMEDAN Learning Hub.

- Invitation to private‑sector pitch events where investors scout for scalable enterprises.

These supports are designed to accelerate growth, reduce default risk, and encourage a shift from informal to formal employment.

Reactions from Stakeholders

Entrepreneurial circles welcomed the move. Aisha Bello, founder of a Lagos‑based fashion label, told us, “We’ve been operating for three years, but the lack of a formal registration kept us from applying for a modest loan. This program could finally give us the runway we need.”

Bankers expressed optimism too. “Formal registration is a key credit‑scoring metric for us. With CAC‑SMEDAN’s guarantee, we expect a surge in lending volume to the MSME segment,” said Mr. Tunde Adebayo, Credit Manager at Guaranty Trust Bank.

Critics, however, caution that the success will hinge on implementation. The Nigerian Union of Small & Medium Enterprises (NUSME) warned, “If the verification process stalls, or if the promised loans remain theoretical, the programme could lose credibility.”

Potential Impact on the Economy

Economists project that formalising an additional 250,000 MSMEs could inject roughly ₦150 billion into the formal economy through taxes, licensing fees and increased productivity. Moreover, with better access to finance, these firms could collectively create up to 200,000 new jobs over the next three years.

In the long run, the move could improve Nigeria’s standing in the World Bank’s Ease of Doing Business rankings, which currently place the country at 131st. A measurable rise in formal business registration would signal a more predictable regulatory environment, potentially attracting foreign direct investment.

Future Steps and Challenges

While the rollout begins in late September, a phased approach is planned: the first 50,000 registrations will be targeted in the North‑East states, where informal activity is highest. Subsequent waves will expand to the South‑West and South‑East. Monitoring will be handled jointly by CAC’s Compliance Unit and SMEDAN’s Monitoring & Evaluation team.

Key challenges include ensuring digital accessibility in regions with limited internet connectivity and preventing fraudulent registrations. To mitigate these risks, the programme incorporates multi‑factor authentication and on‑ground verification agents.

Looking ahead, both agencies hinted at a possible “second‑stage” where registered MSMEs could apply for a subsidised tax holiday for up to two years, further encouraging formalisation.

Key Facts

- Date announced: September 27, 2025

- Target: 250,000 MSMEs across 36 states + FCT

- Primary agencies: Corporate Affairs Commission (CAC) and SMEDAN

- Registration portal: portal.smedan.gov.ng

- Additional benefits: loans, grants, insurance, training, investor pitch events

Frequently Asked Questions

How does the free registration program affect existing informal businesses?

Informal businesses that meet the eligibility criteria can apply through the online portal and, once approved, receive a formal certificate without paying the usual CAC fees. This instantly opens doors to bank loans, government grants and insurance that were previously unavailable to them.

What types of loans are available to newly registered MSMEs?

Partner banks have pledged collateral‑free micro‑loans ranging from ₦500,000 to ₦5 million. Eligibility hinges on the new registration number, a viable business plan and, in some cases, participation in SMEDAN‑run training modules.

Who is eligible to register under the program?

Any micro, small or medium enterprise operating in Nigeria’s 36 states or the Federal Capital Territory can apply, provided they have a verifiable owner’s ID and a legitimate business address. Start‑ups, family‑run shops and even informal traders transitioning online qualify.

What support does SMEDAN offer after registration?

SMEDAN’s Business Gro platform delivers ongoing mentorship, sector‑specific training, and access to private‑sector investment showcases. Registrants also receive regular newsletters with updates on grant cycles, insurance offers and market‑entry opportunities.

When will the next wave of registrations open?

The first batch of 50,000 slots launched on October 5, 2025, focusing on the North‑East region. Subsequent phases are slated for November and December, each covering a different cluster of states. Updates will be posted on the SMEDAN portal.

Comments (12)

Imagine the doors that swing open when a small business finally gets a legal name – it’s like a quiet poem turning into a loud anthem. Registration isn’t just paperwork; it’s the first line in a story that can echo across markets and neighborhoods. The CAC‑SMEDAN initiative gives entrepreneurs that opening stanza for free, and that feels like a friendly hand on the shoulder of anyone daring to dream. Let’s celebrate the chance to move from the shadows into the sunlight of formal support.

Esteemed members of the community, I commend the collaborative effort between the Corporate Affairs Commission and SMEDAN for reducing procedural barriers. This program exemplifies a structured approach to economic development, offering tangible benefits such as credit access and capacity building. It is advisable for prospective registrants to meticulously follow the outlined steps to ensure compliance and timely verification. The initiative stands as a precedent for policy‑driven entrepreneurship support.

The proclamation of gratuitous registration constitutes a paradigmatic shift in Nigeria’s micro‑enterprise jurisprudence. By obviating pecuniary impediments, the CAC‑SMEDAN consortium effectuates a salient recalibration of market entry dynamics. It behooves scholars and practitioners alike to scrutinise the ancillary instruments-namely, loan facilitation and insurance underwriting-afforded concomitantly. Such an integrated schema merits rigorous academic exegesis.

Reading through the details of the Business Gro program evokes a mosaic of considerations that span governance, finance, and social impact. First, the sheer magnitude of targeting 250,000 enterprises signals an ambitious scaling of formalisation that few economies have attempted in a comparable timeframe. Second, the alignment of registration with subsequent access to collateral‑free loans introduces a vertical integration of support that could mitigate the classic bottleneck of credit scarcity. Third, the inclusion of insurance products addresses risk aversion that often deters informal operators from transitioning. Fourth, the training modules on digital marketing and bookkeeping suggest an acknowledgement that registration alone does not guarantee competitiveness. Fifth, the phased rollout-beginning in the North‑East-reflects a data‑driven strategy to pilot interventions in regions with high informality. Sixth, the multi‑factor authentication and on‑ground verification agents demonstrate an awareness of fraud risks inherent in large‑scale digital enrolment. Seventh, the potential second‑stage tax holiday could further incentivise sustained compliance beyond the initial registration. Eighth, the partnership with partner banks and private foundations indicates a public‑private synergy that may enhance resource mobilisation. Ninth, the projected injection of ₦150 billion into the formal economy underscores the fiscal implications of broadened tax bases. Tenth, the anticipated creation of up to 200 000 jobs aligns with broader employment objectives. Eleventh, the programme’s monitoring apparatus, jointly managed by CAC and SMEDAN, could serve as a blueprint for future governance frameworks. Twelfth, the accessibility of the portal, despite internet connectivity challenges, remains a pivotal factor for equitable participation. Thirteenth, the requirement for owner identification and proof of address introduces a layer of due diligence that safeguards data integrity. Fourteenth, the engagement of the Nigerian Union of Small & Medium Enterprises as a watchdog adds a civil‑society dimension to oversight. Fifteenth, the prospective boost in the World Bank’s Ease of Doing Business ranking may attract foreign direct investment, creating a virtuous cycle. Finally, the synthesis of registration, finance, insurance, training, and market exposure constructs a holistic ecosystem that could redefine entrepreneurial trajectories across the nation.

While the narrative paints an optimistic tableau, one must remain vigilant of the underlying machinations that often accompany such grand announcements. History teaches that elite interest groups frequently embed conditional levers within ostensibly benevolent schemes, steering benefits toward pre‑selected corridors. The involvement of major banks, for instance, could mask a subtle agenda to funnel liquidity into pre‑approved portfolios, marginalising truly grassroots enterprises. Moreover, the digital portal, though lauded for its simplicity, may serve as a conduit for data harvesting, enabling surveillance of burgeoning entrepreneurs. The programme’s success therefore hinges not merely on policy execution but on exposing and neutralising these covert influences that could otherwise subvert its intended egalitarian impact.

It is disheartening to witness the same old game of hidden interests being played out in yet another African nation while our own brothers and sisters endure the burden of external exploitation. The drive to formalise Nigerian MSMEs should have been an opportunity for genuine empowerment, yet the overt reliance on foreign‑backed banks and international sponsors mirrors the very colonial dynamics we have long fought against. We must ask why local Indian financial cooperatives are not invited to partner in such transformative ventures, especially when our diaspora entrepreneurs have repeatedly proven their capacity to stimulate growth. The narrative of “development assistance” often conceals a subtle extraction of data and resources that ultimately benefits external powers more than the indigenous business community. It is imperative that the programme adopt a truly sovereign stance, prioritising home‑grown capital and restricting the flow of sensitive information to foreign entities, lest we repeat the patterns of economic subjugation.

Wow what a great step forward for so many founders love seeing barriers melt away this will open doors for small shops and startups alike lets hope the process stays smooth and people get the support they need

Absolutely 🙌 this is the boost many entrepreneurs need 🎉 looking forward to seeing businesses thrive and communities grow 🚀 keep the momentum going 😊

Free registration could really change the game for many Nigerian startups.

i gotta say dis initiative is kinda lit its like a fresh breeze in a desert of red tape but lets not get too comfy cos there’s always some behind the scenes shadey stuff happenin

Oh great, another free service that will surely be delivered on time without any hiccups. Because we all know bureaucracy loves efficiency.

The assertion presented is an oversimplification it fails to account for systemic delays and the entrenched inertia within administrative processes thereby rendering the optimism unfounded